What Does “Medically Necessary” Mean?

According to the Medicare glossary, medically necessary refers to:

Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine.

Anything deemed “medically necessary” is vital to the Medicare process and coverage because Medicare only helps pay for what is absolutely needed to help treat an injury, illness, or other medical condition.

This means that the deductible and premiums you pay for treatment that falls under Part B (as well as Part C, which covers what parts A and B do, and Part D, which covers prescription drugs) will only cover the services or equipment used to treat your condition. If a service or piece of equipment is not used to treat your condition, you will most likely have to pay for it completely out of pocket.

Medicare covers more than these medically necessary services, though. Parts A and B also cover “preventative services,” which you could argue are medically necessary as well because they could help “diagnose or treat an illness, injury, condition, disease, or its symptoms.”

These services include:

- An annual wellness visit

- Diabetes screenings

- Mental health screenings

- Vaccines

- STI screenings

- Colonoscopies

- Bone density screenings

- Breast examinations

For the sake of this article, we’ll focus on the services that are “medically necessary,” but know that preventative services are covered by Medicare, too. Before we get into the remaining “medically necessary” coverage, let’s discuss how treatment or equipment is declared medically necessary in the first place.

How Is Something Deemed “Medically Necessary”?

This is determined by the federal government. Simply put, Medicare covers anything deemed medically necessary, and it largely doesn’t cover anything not considered medically necessary. Also, when it comes to private Medicare Advantage plans, there are added “medically necessary” coverages that may be included in your plan.

For example, a Medicare Advantage plan covers everything that parts A and B of Medicare do, but it may also add vision and dental plans to your coverage and deem them medically necessary. This is actually why Advantage plans often cost more, because they often include more medically necessary coverage.

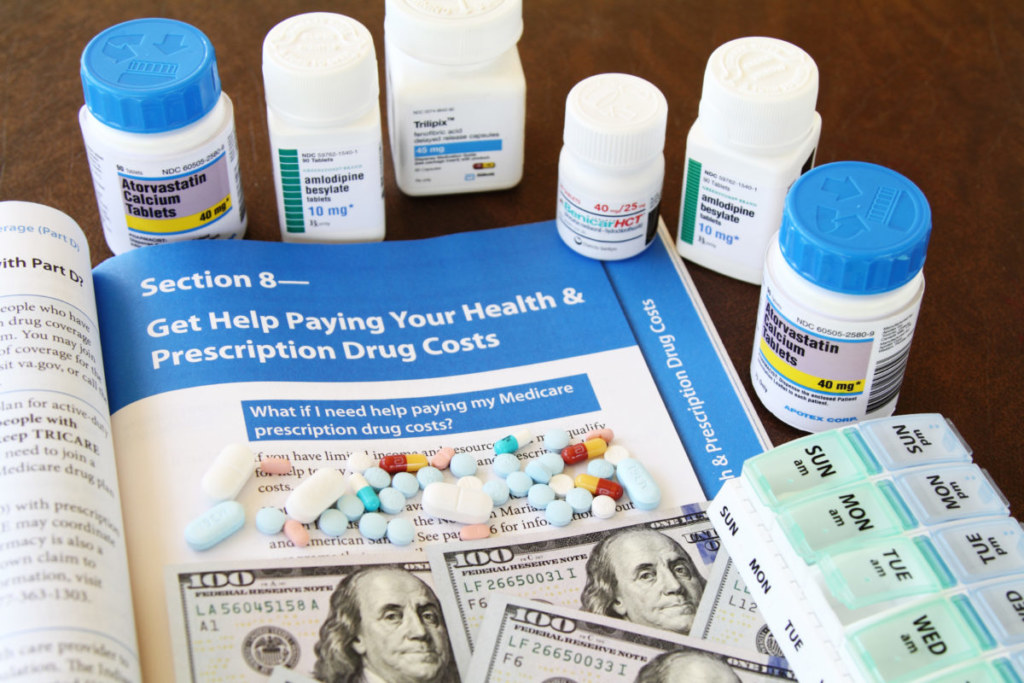

Prescription drugs, as long as they are used to treat a condition, are also “medically necessary” and are covered under Part D.

While most services and equipment are universally deemed medically necessary, you may occasionally run into a piece of equipment that needs to be approved as medically necessary by your doctor in order for Medicare to cover it. This helps protect the government from people ordering equipment they don’t need and wasting money.

In the event that you need to fill out a form to prove medical necessity, there is a general form titled Request For Evidence of Medical Necessity you can find at your local Social Security Administration office. Your doctor’s office or insurance company may also provide this form, which will help prove that orthotics, prosthetics, equipment, and related items are necessities.

You may need specific medical necessity forms for services and equipment such as:

- Seat lift mechanisms

- Oxygen therapy equipment

- Positive Airways Pressure devices for sleep apnea

- Pneumatic Compression Devices

Now, let’s talk about what types of services and equipment fall under the “medically necessary” umbrella of Medicare.

What Medicare Coverage Relies on “Medically Necessary”?

As mentioned earlier, “medically necessary” services and supplies fall under parts A and B of Medicare. If the federal government determines that it’s necessary, then it’s covered.

Some of these services include but are not limited to:

Hospital Stays (Up To A Certain Length):

Medicare covers services at in-patient hospitals (acute care, inpatient rehab, critical care, long-term care) such as general care, meals, general nursing, and prescription drugs you need during your stay. This care is provided at the Medicare rate for the first 90 days of a stay, and for 60 “lifetime reserve days.” Any service after that is deemed medically unnecessary, and we’ll cover that later on.

Skilled Nursing Home Stays:

Medically necessary coverage at skilled nursing home stays includes physical and occupational therapies (until your goals for good health are met), a semi-private room, skilled nursing care, medication, dietary counseling, ambulance transportation, and more.

Hospice Care:

In hospice care, which focuses on caring for those who are terminally or seriously ill, Medicare will essentially cover the entire stay including the doctor and nursing care, the equipment (such as a wheelchair), and any therapy needed to help facilitate the end-of-life care for a patient.

Home Health Care:

Medicare will also cover home health care services. This include part-time skilled nursing and home health aide care, physical therapy, occupational therapy, and speech therapy. Medicare will not cover round-the-clock nursing care.

Ambulance Services:

Transportation is particularly necessary for the elderly who are sick, living alone, or living in nursing homes. Medicare helps cover these costs, as they’re a medical necessity for certain folks to receive the care they need. These costs will only be covered “when other transportation could endanger your health,” such as when you’re in shock, unconscious, bleeding profusely, or other Medicare-approved circumstances.

Visits To The Doctor:

Visits to a doctor’s office is considered medically necessary when it comes to treating or diagnosing a medical condition. This includes second opinions (which you can use to confirm a diagnosis) and surgery recommendations on whatever condition you have. Medicare will also cover inpatient and outpatient mental health care.

Durable Medical Equipment:

This is related to covered for items such as seat lifts and wheelchairs. Durable medical equipment (DME) is equipment that can withstand repeated use and is used to help treat an illness or condition. “Medically necessary” DME includes walkers, patient lifts, wheelchairs, crutches, and oxygen equipment. As mentioned, you will likely need to have a form signed that says these pieces of equipment are “medically necessary.”

Again, these are all deemed “medically necessary” under parts A and B of healthcare. They’re also covered under Part C of your Medicare Advantage plan. Prescription drugs, as long as they are used to treat a condition, are also “medically necessary” and are covered under Part D.

What Isn’t “Medically Necessary”?

Services that aren’t deemed “medically necessary” include everything Medicare won’t cover. In a CMS pamphlet that lists everything not covered under Medicare, the primary category is “services and supplies that are not medically reasonable and necessary.”

When it comes to equipment, sometimes not every part of the equipment is covered by Medicare.

These services include:

- Hospital services that could be administered in a “lower-cost setting” like the person’s home or a nursing home.

- Excessive hospital stays beyond what is deemed “medically necessary.” As mentioned, Medicare will pay for part of your hospital stays up to 90 days at a time, and then they will give you 60 “lifetime reserve days.” Beyond that, Medicare doesn’t deem your stay “medically necessary” (in most cases).

- Any screening, test, and therapy unrelated to a condition or diagnosis that does not have any symptoms. (You are allowed one wellness check up every year, though.)

- Excessive therapy

- Excessive procedures used to diagnose your condition

- Procedures or accessories used to assist or cause death, also known as assisted suicide, which is allowed in some states (but not covered by Medicare).

When it comes to equipment, sometimes not every part of the equipment is covered by Medicare. For example, lift chairs—devices that help people with severe arthritis stand up and sit down— are medically necessary devices, but only the contraption that helps the person get up and lay down is covered.

This means that the seat, fabric, and cushions aren’t covered. In this case, Medicare will cover 80 percent of the cost (the normal rate for Part B services) of the device, and you will pay out of pocket for the rest of it. So, even when a contraception or equipment is medically necessary, you should make sure that its accessories are also covered by Medicare.

There are some prescriptions that aren’t medically necessary either. These include weight loss pills, fertility pills, and drugs that treat erectile dysfunction.

What Happens When I Need Something That Isn’t “Medically Necessary?”

If you need a service or piece of equipment that isn’t covered by Medicare, your provider will most likely ask you to fill out a form known as Advance Beneficiary Notice of Noncoverage. Signing this form means that you accept that the particular service won’t be covered by Medicare and that you will have to pay the entirety of the cost.

However, signing this form doesn’t mean that your service definitely will not be covered by Medicare, but rather that the provider believes it won’t be and is covering themselves from any liability. You still may be able to make the case to Medicare that the service is “medically necessary.”

If you have any other questions regarding what is or isn’t deemed medically necessary by Medicare, contact your local Social Security Administration office or have a conversation with your medical provider.

Do you want to cite this page? Use our ready-made cite template.