Aetna itself accounts for approximately 7 percent of all Medicare Advantage enrollees. It has the fifth-largest market share of Medicare Advantage plans of any insurance company as of 2017. Medicare Advantage enrollment numbers are expected to reach an all-time high in 2019 with more than 22 million customers, so if Aetna’s 7 percent market share from 2017 holds steady for 2019, the company should expect more than 1.5 million enrollees in its Medicare programs.

Let’s discuss the plans Aetna offers, where and when they’re offered, and how to get them.

Aetna’s Medicare Plans

All plans acquired through Aetna that cover parts A and B of Original Medicare are called Medicare Advantage plans because they are acquired through a private Medicare-approved provider. These plans are considered Part C of Medicare. What makes Advantage plans so enticing is that they usually offer additional preventive coverage, which can include vision and dental, and prescription drug coverage.

What makes Advantage plans so enticing is that they usually offer additional preventive coverage, which can include vision and dental, and prescription drug coverage.

Medicare Advantage plans like Aetna’s give you a one-stop shop for all your insurance purposes, with one premium rate per month, one deductible rate per year, and consistent co-payment costs at the doctor’s office. Aetna also offers prescription plans for Medicare and supplemental insurance plans (known as Medigap) that help pay for everything that Medicare doesn’t cover (copayments, deductibles, 20 percent of durable medical equipment, etc.).

The important thing to remember about these Aetna plans—and all plans offered by insurance companies—is that they are flexible. There aren’t only one or two plans to choose from, either, in most cases. Every type of insurance plan, from an HMO to a PPO, has multiple options that help fit the coverage you need in your state or region. Given that everyone’s medical situation is different, there are Medicare Advantage plans to fit specific situations.

Aetna Medicare Advantage PPO

Aetna’s Medicare Advantage PPO plan gives you the widest range of doctors and services that can be covered, because that’s what a PPO plan does. It allows you to see out-of-network doctors with less restrictions, or not restrictions at all, rather than if you were on another plan like an HMO or SNP. These out-of-network doctors must be approved by Medicare, as well.

This convenience of seeing out-of-network doctors means that PPO plans cost more money, but they also broaden who you can see. This is particularly important if you or a loved one has a medical situation that requires the attention of many doctors in the area, all whom may not be in Aetna’s network. You don’t necessarily need a referral from an Aetna-approved doctor to see a specialist, either, like you would with an HMO plan.

In addition to the coverage of parts A and B, Aetna Medicare Advantage plans promise services “such as unlimited hospitalization and coverage for certain preventive services.”

Aetna’s national PPO plan received a four-star rating (out of five) by the Centers for Medicare and Medicaid Services.

Aetna also offers a variation on this PPO plan called a PFFS, which is a “private fee for service” plan. With this plan, you don’t need to choose a primary care physician, and you don’t need to be referred to a specialist to use their services. You can use any Medicare-approved doctor with this plan, as long as they accept the terms. You will pay a pre-set percentage of charges with this plan, or you may have high copayments with a deductible to meet each year.

Aetna Medicare Advantage HMO

As one of its Medicare plans, Aetna offers an HMO that allows you to choose from a list of doctors and services within the provider’s network.

As one of its Medicare plans, Aetna offers an HMO that allows you to choose from a list of doctors and services within the provider’s network. While this may limit which doctors you’re covered by, with an insurance company as large as Aetna, you will most likely be able to find an option in their network that you feel comfortable with.

Because of this in-network restriction, you will need to select a primary care physician within Aetna’s network to be your home base for your medical needs. From there, your doctor will refer to other in-network doctors if you need to see a specialist.

The Aetna Medicare Advantage HMO offers a host of other coverages outside of your basic services covered by parts A and B. According to Aetna, nearly 20 states including Florida, Texas, and New York are in its custom HMO plan that offers full coverage on vision, hearing, rehab services, inpatient mental health facilities, and more on top of everything parts A and B cover. This plan also offers minimal co-payments ($10 to $35) on visits to your primary care physician, the emergency room, and other specialist visits.

Aetna also offers a version of an HMO plan called a Open Access HMO. With this plan, you can see any in-network primary care physician or specialist without a referral. This gives you more freedom in-network without having to pay large costs for going out-of-network.

Aetna Medicare Advantage HMO-POS

This type of Medicare plan offered by Aetna is like a combination of an HMO and a PPO. An HMO-POS plan allows you to get a small list of approved services outside of the Aetna network on top of the full list of approved services you’d get with an HMO plan. This allows a little more flexibility in your coverage of certain conditions. The downside is that these out-of-network services come at higher out-of-pocket costs.

Aetna Medicare DSNP

These Dual Special Needs Plans (DSNP) are for people who have both Medicare and Medicaid. Other people who qualify for DNSPs include:

- People who live in institutions such as a skilled nursing facility

- People who suffer from a limited list of chronic illnesses like diabetes or end-stage renal disease (if you have one of these and are under 65, you may be able to qualify for this plan)

Under a DSNP, you will pick a primary care physician, and he or she will refer you to specialists. In addition to everything covered by Medicare parts A and B and Medicaid, Aetna DSNPs will cover:

- Transportation to and from doctors appointments

- Vision, dental, and hearing

- Prescription drug programs (this is required by law)

- Fitness programs (in some cases)

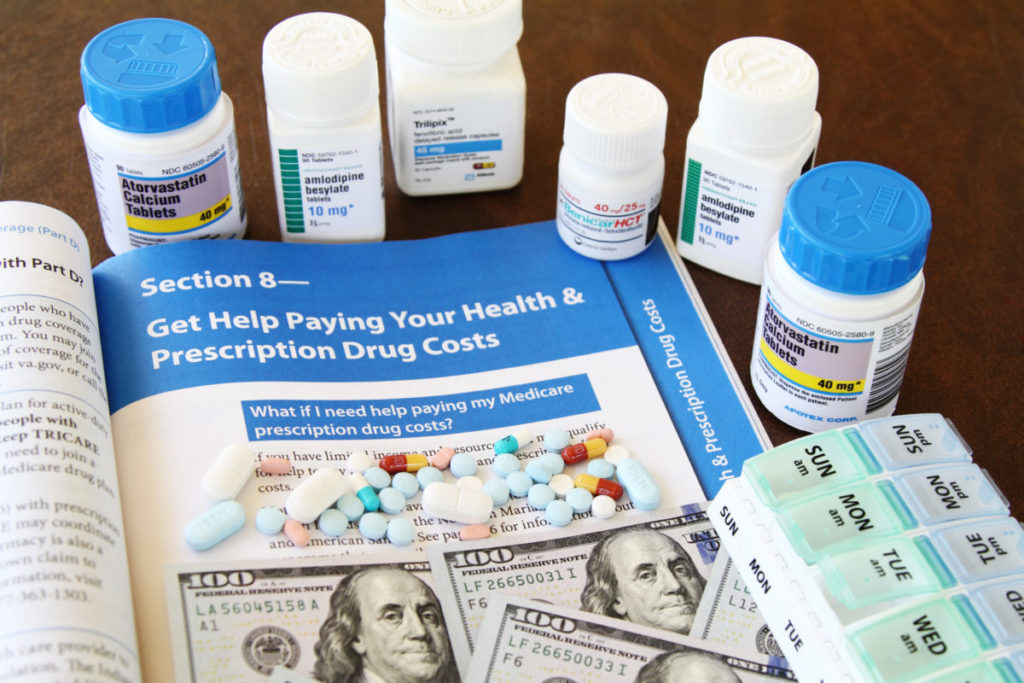

Aetna’s Prescription Drug Plans

All of the aforementioned Aetna plans may come with prescription drug plans attached. But not everyone settles on an Advantage plan with prescription drug coverage.

All of the aforementioned Aetna plans may come with prescription drug plans attached. But not everyone settles on an Advantage plan with prescription drug coverage, and not everyone who goes to Aetna wants an Advantage plan in the first place—some want just prescription drug coverage. This is why Aetna offers stand-alone prescription drug plans.

These stand-alone plans cover varying combinations of prescription drugs. Some use a tiered system, meaning the larger the list of drugs covered in a plan, the more likely it is to have a higher per-month premium. These lists (also known as a drug formularies) vary based on your state (and sometimes county). You can view Aetna’s drug formulary here.

The drugs covered on each list can change, and Aetna is required to let you know in writing if a drug you need is no longer covered by your plan. Even so, it’s recommended that you stay on top of your personal list to make sure you’re covered. The premiums for stand-alone prescription drug plans range from $0 to $200 per month.

Aetna’s Supplemental (Medigap) Plans

Aetna also offers supplemental insurance—known as Medigap—to help pay for everything that Medicare doesn’t cover. This is for people who have Original Medicare, because you can’t have a Medicare Advantage plan and a Medigap plan. While Medicare covers a large amount of your healthcare costs, it won’t cover everything. The gap between costs that are covered and costs that aren’t can grow for some people, which is where Medigap can help. This supplemental insurance can cover:

- Hospital costs for up to a year after Medicare benefits cease

- Coinsurance costs (usually 20 percent of Medicare-approved costs)

- Copayments

- Three pints of blood

- Deductibles

Most Medigap plans don’t come with a deductible, but they have a monthly premium. However, some plans offer a high deductible rate that helps to decrease the monthly premium cost. You can view the supplemental insurance plans Aetna offers in each state here.

When Can I Get A Plan With Aetna?

Let’s start with the basics: you can acquire a plan with Aetna during the Medicare Initial Enrollment Period (IEP). This period lasts the three months before your 65th birthday month, your whole birthday month, and three months after your birthday month. For example:

Aetna overall covers over 23 million people, with almost 700,000 primary care physicians and specialists and over 5,700 hospitals in their network.

- If your 65th birthday is August 17th, 2019, your IEP lasts from May 1, 2019, all the way to November 30, 2019.

If you missed this or another special enrollment period you were eligible for (like when you’re moving from a company’s insurance plan to a Medicare plan), you can enroll in an Advantage plan during the General Enrollment Period, which lasts from January 1 to March 31.

However, if you already have a plan with a private company but want to transfer to Aetna, you can do so during the Open Enrollment Period. This lasts from October 15 to December 7 every year.

How To Get A Medicare Plan With Aetna

Aetna overall covers over 23 million people, with almost 700,000 primary care physicians and specialists and over 5,700 hospitals in their network. This coverage is featured in all 50 states.

To find out which specific plans are offered in your area, you can go to Aetna’s Medicare website, enter your zip code, and search through the plans. You could also let the website guide you and suggest plans, during which you need to share some basic information like your medical history (generally described as “good,” “fair,” or “poor”), age, and prescriptions.

Each plan will have certain qualities that you should pay attention to. These include:

- The list of hospitals/specialists/primary care physicians that are covered on the plan

- How much the copays are for each doctor visit

- The star rating of the plan (rated on a scale of one to five, with five being the highest)

- The yearly deductible

- The maximum you’ll pay every year

If you have any questions regarding Aetna’s Medicare plans, visit the company’s website. Non-members who have questions can call them at 1-855-335-1407 (TTY: 711).

Do you want to cite this page? Use our ready-made cite template.